Startup School '07: March 2007 Archives

Mark Zuckerberg at Startup School 2007.

importance of being young, and being technical & building things

being technical

- first 10 people at facebook were technical

- first CSR wrote code to automate the process - gave him leverage

- coding gets you into a position of leverage - work can be utilized beyond raw effort

focus on iteration

- empower people who do the building (technical folks)

- get rid of layers between build and customers

Facebook's mission - "trying to make the world a more open place"

being young

- less clutter in life (mortgage, responsibilities, etc) - leaves room to be idealistic

- allows you to focus on what's important

Facebook is currently handling 1.5 billion page views a day

- can only do that because they are a deeply technical company

- even management is technical

Mark takes a moment to promote the Facebook development platform

- makes facebook provide "friend infrastructure" to the internet

- their openness here, if they do it right, could be really freakin' huge

facebook is a technology company, not a media company. guides how the hire (technical), and how they direct their efforts. Guides the culture of the company.

facebook is getting people to share a lot more data, because it gives control of the audience - you can share photos just to your org, school, etc.

work w/ people you have a high trust, high bandwidth communication with

Ali Partovi - Founder, iLike

Hadi Partovi - President, iLike

Ali and Hadi Partovi at Startup School 2007.

Is my idea a winner? better metric is the team or group of people

- can i easily explain what the customers need in one or two sentences?

- does the business scale - can you double your revenue w/o also doubling costs?

- am i creating added value? book - "co-opitiion" size of pie when i'm in the game, vs. when not in the game -- that is the added value.

- will the users naturally recruit new users?

- network effect - will the value delivered to each customer increase as # of customers increase?

- passion - is the entrepreneur passionate about the idea?

Do's:

- listen to customers, identify with them. critical to actually listen to them yourself.

- rank top problems most critical to success - rank top people, assign top people to top problems (for bigger companies). delegating effectively

- make frugality and profitability part of your culture. avoid a luxurious environment. cut spending anywhere you can.

- move quickly. make decisions fast! avoid committees. avoid 12-month development projects.

- have a strong CEO. best sales person, outward person as CEO.

- FOCUS - can't afford to be spread thin when company is small.

- hire great people. judging people is most important skill you can learn in business.

Don'ts:

- be distracted by the press; don't make decisions based upon press coverage. value is to help with recruiting or to aid with strategic partners.

- don't take your company culture for granted - natural flow is for organizations to become political. want to start thinking about this at the early days, to keep it going.

- don't be greedy in business negotiations. let other company have bigger piece of pie, in return for speed

- don't ignore your gut feel about an employee or candidate

- forget to have fun.

Max Levchin, Slide; founder at PayPal

Max Levchin at Startup School 2007.

engineers aren't as good at handing all details, product management is in making sure all bits get accounted for.

iterate over different ideas

hackers make the best PMs - Google does one thing right, having CS majors as their PMs.

product people need to really put themselves in the experience of the audience.

measure everything in order to determine what works. million packages out there --- they all aren't good enough, have to build your own

- focus on the metrics, pick out the patterns

- find the anomalies in the chart - things that user want to do

make your users commit - there is a balance between making things too easy (people will think that the payoff won't be as high) vs. too hard (too much commitment - people drop out)

Michael Mandel - chief economist at BusinessWeek

Mr. Mandel's talk was more informal - he spoke from notes instead of slides. However it was highly engaging, provocative, and thought-provoking (and was one of the best talks of the day). Here are my rough notes:

trying to give the larger economic context around startups

u.s. economy today - mature economy, filled with big companies, that don't want their lives disrupted. these executives talk about innovation, know they need it, but at the same time- it makes their skin crawl - innovation is too unpredictible, too chaotic

conventional economics is uncomfortable with the idea of innovation as well. 50% of economic growth is from innovation. Few economists take this into account.

economists view innovation as an unnatural act - creating something from nothing is alchemy

economic statistics are terrible for tracking innovation. example - talk is that R&D is lifeblood of economies - either shows up as consumption, or doesn't show up at all.

facts that you need to know:

- other countries have higher saving rates then U.S.

- other countries have access to same technologies

- US has almost unique ability to provide positive environments to startups

- startups are reason why U.S. economy is still competitive, and hasn't fallen off the map

3 reasons why the U.S. has been great for startups:

- encourage people to take chances

- reward people well if they succeed

- allow business that are not succeeding to go under - very important, free's peoples talents to go to the next thing

role of VCs - partly what they do is give out money, what they also do is wrest control away from founders who have good ideas, but don't know how to manage their business.

economic context - we live in a global world (India & China). these are great success stories - India problem is lack of infrastructure. China is in a boom phase, where everything comes easy. we really won't know how competitive China is until they have to deal with a bust. we don't know how big the bust is going to be -- the chinese government restricts the flow of information.

been at business week since 1989 - very hard to cover technology companies, hard to see what companies will work, what the next big innovation is going to be

big economic fears going forward - not worried about sub-prime lending, not worried about trade or budget deficits, not worried about social security or medicare.

- worried about slowdown in productivity growth the most.

1. what would it take to get faster innovation? need more basic R&D (government)

2. political system where government was really in favor of innovation. gov. can't innovate, but can stop it

michael_mandel@businessweek.com - encourages people to e-mail him (he will respond), also has a blog

Q&A:

I asked a question about Sarbanes-Oxley - Mr. Mandel's response was that initially (at his first Startup School talk), he was somewhat opposed to Sarbanes Oxley, but more recently, his opinion has changed - in light of the recent stock option back dating scandal(s). It seems like the issues around SOX aren't necessarily black and white.

new companies are explorations - go out and figure out if something is true or not. adding new information to the world - that is not a commodity.

you can't fight reality. china has gone from producing 1m college grads a year to 4m in a very short time.

smallbiz - offshoot of business week for giving advice to small businesses.

Been doing Y Combinator for 2 years now. Did 8 startups at first, 4 succeeded.

He thinks he'll be able to do 25% success rate over the long term. But even the failures, it was't that bad - some went on to other things, others were able to sell assets on eBay, and go on to another project.

Nobody would trade startup work for work in a cubicle.

Why don't more people do it?

The anatomy of reluctance

- too young - median age in the world is 27. Maybe. Ready when you are an adult

- Too inexperienced. Paradoxically, if you are too inexperienced, you should do it anyway.

- Not determined enough - that is a problem. Determination is the single biggest predictor of success.

- Not smart enough - not as big of a problem. Not if you worry about it. (write enterprise software - not a tech business, a sales business - depends mostly on effort)

- Don't understand business - not the hard part anyway. Hard part is making something great, can figure out business part on the fly.

- No cofounder - a real problem. Everybody agrees about this one. This is first order problem to solve - preferrably one you've known for awhile and trust.

- No idea - look at what's missing in your own life, see what's missing. No matter how narrow/specific it seems, still a great source of ideas.

- No room for more startups - false. Usually hear it as "how many startups can Google, Yahoo, and Microsoft buy?" A market will evolve to buy these companies if they have value.

- A family to support - a real problem. Would not advise you to start a startup.

- Independently wealthy - already have enough money, why do it? Legit.

- Don't fence me in - don't want to be locked in.

- Need for structure - don't go work for a startup. Nobody telling you want to do at a small startup.

- Fear of uncertainty - if you start a startup, you'll fail - that solves the uncertainty problem.

- Don't realize what you're avoiding - working at regular job sucks, motivates you to work harder at the startup.

- You're parents want you to be a doctor - treat this as a feature request. Parents are always too conservative with their kids.

- A job is the default - inertia.

Chris Anderson, editor-in-chief of Wired, author of "The Long Tail" (blog)

I didn't actually take notes during Chris Anderson's talk - but it was pretty good (I'm a big fan of the "Long Tail" concept). I did grab a couple of his slides, however, that I'll try to annotate:

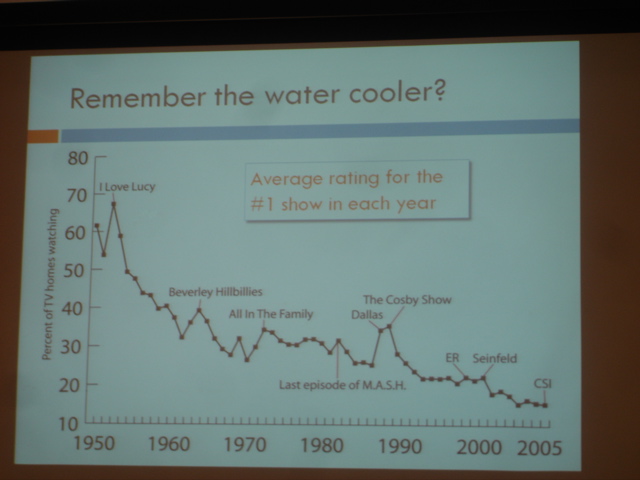

Remember the water cooler?

The neat thing about this slide was the point that Mr. Anderson made about consumer choice -- the more choice that consumers have (in this case TV channels to watch), decreases the channel that everyone watches at one point in time. As the Internet allows us to essentially have "infinite" channels, that means that the era of the "hit" is going to forever disappear. I'm not sure that hits will go away forever (things tend to be annoyingly cyclic), but it is certainly gone for the foreseeable future.

Another interesting fact (that wasn't shown) is that even as the eyeballs-per-hit-show have gone steadily down, the ad revenue per hit show has gone up. I believe that this trend may now finally be coming to an end, which is really going to start to disrupt the media companies (in a way that 500 channel satellite TV never did).

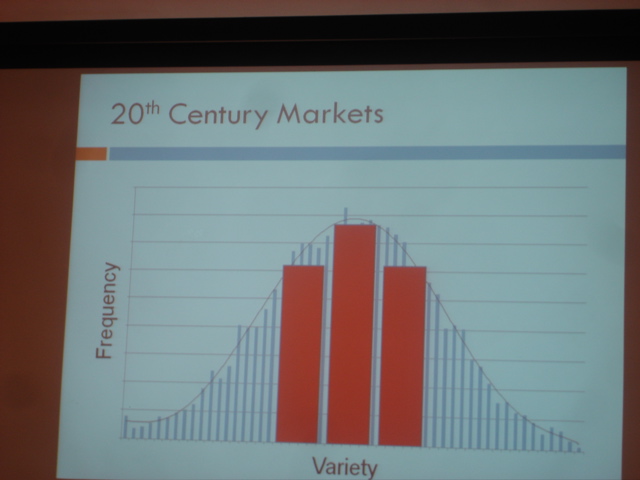

20th Century Markets

The point here is that 20th century markets, due to the physical constraints of the realm (shelf space, TV bandwidth, radio bandwidth, etc.) offered less variety, therefor forcing the market to work in a hit-driven way.

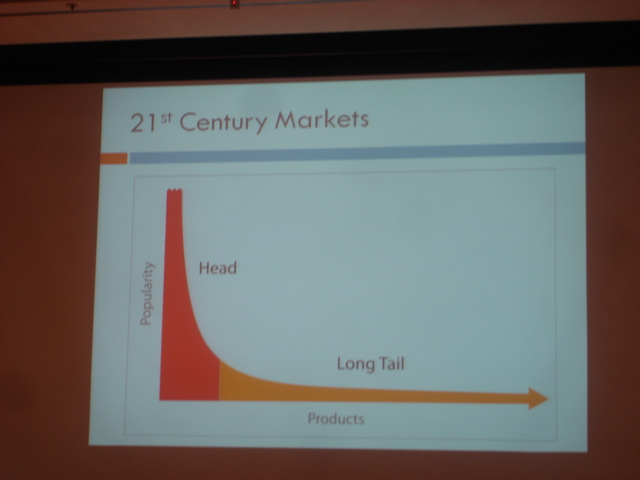

21st Century Markets

In 21st century markets, the physical constraints melt away (Amazon has essentially unlimited shelf space, YouTube limitless "channels") - so it is possible (and lucrative!) to monetize the long tail - lower volume, more niche.

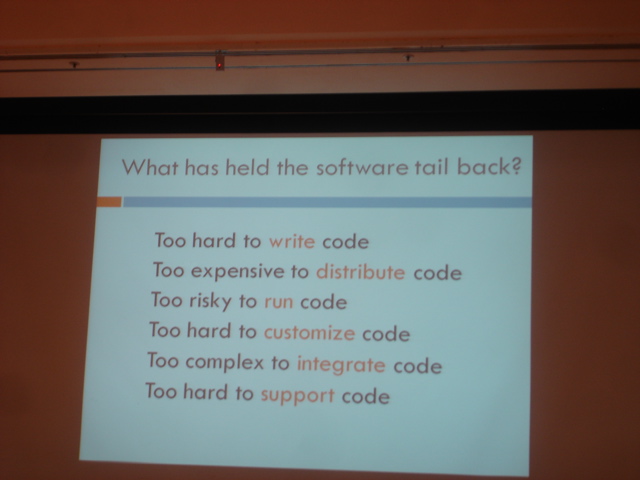

What has held the software tail back?

It is interesting to think about the Long Tail of software. This basically refers to software applications that have a limited audience. The example that Mr. Anderson gave was software for bicycle shops - something that Microsoft would never target, but that doesn't mean it isn't needed, or that it can't be delivered profitably.

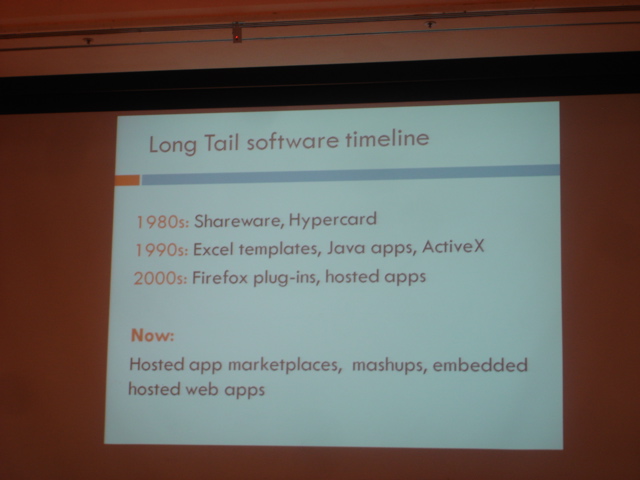

Long Tail software timeline

What's interesting, to me, is that not only are people using today's technologies to better-serve the Long Tail of software better than ever before, but people started building businesses around this market years ago (i.e. Salesforce AppExchange, JotSpot). The prescience of that fact amazes me.

Paul Buchheit (blog) - Creator of GMail

Paul Buchheit speaking at Startup School.

Advice on advice

- where does advice come from -- limited life experiences + overgeneralization = advice

- doesn't mean that advice is worthless, have to remember where it is coming from.

- helpful advice

- opens your eyes so you can see more clearly,

- gives close about the overall picuture, how your part fits in

- opens your eyes so you can see more clearly,

- watch out advice that is limiting. Remember that no one hs it all figured out.

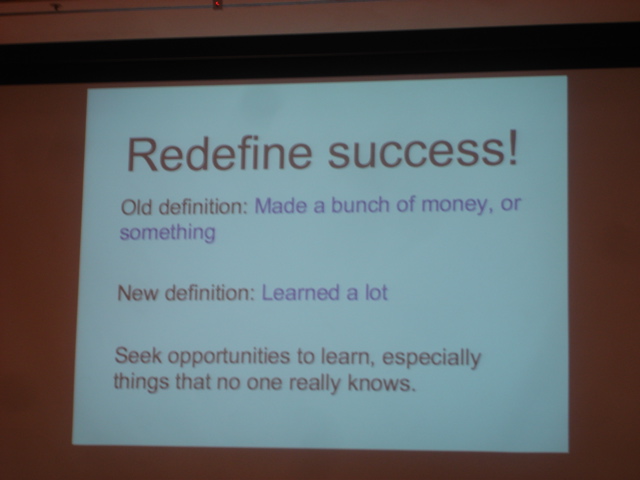

Redefine success.

Redefine success

- attempt things with uncertain outcomes - but uncertain outcomes that you'll learn from

- redefine goal of startup - if learning is goal, then startups are a great place to learn, and you can achieve that goal

Make something that is different

- how can you tell hat a product is fundamentally different? by how people use it -- Altavista, 2 times a week. Google, 10 times a day.

- please remember - being useless in new ways does not make you different from previous useless products

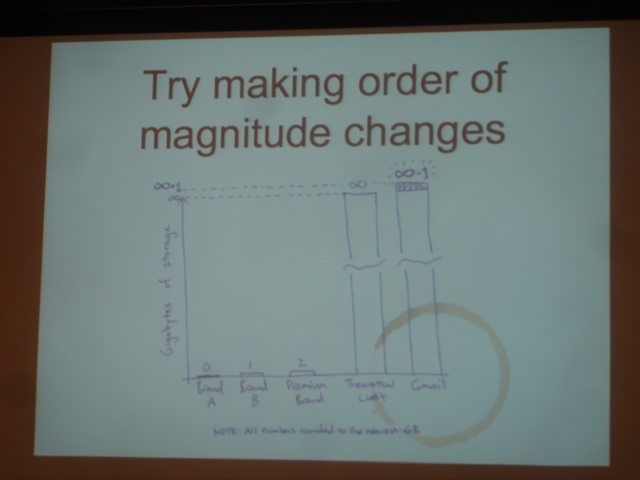

GMail - changing the magnitude.

Quick tips on scaling web service

- disks are not really random access - capacity doubles every year or two, but seek times remain the same

- relative seek time is actually decreasing, as disks get bigger.

- solution - think of disk drive as a sequential access device

- how build around this?

- big data, small data

- big - photos, video, mp3 (you can just put it in amazon s3)

- small - tags, names, meta data (keep it in RAM)

- big data, small data

- DB updates must avoid cause seeks - updates go to a transaction log. All writes are sequential.

Mark J. Macenka, Goodwin Procter LLP

Law firm specializing in helping out startups, thought he would give advice based upon past experience

Beginning:

- Business side - really important to study market, competition, know users (and their pain).

- Imperitive to stay focused, and love what you do.

- entrepreneurs get caught up in trying to keep control of company - can be to the detriment of getting the business going. needs to be all about making products, solving needs, making money. Encourage entrepreneurs to get money through the door, and give up chunk of business.

- Value of board of directors is independent people - not just your friends/family (you'll get their advice anyway).

- network - people that you know who have done startups before - network is invaluable. get strategic/tactical advice.

Capital Structure

- Keep it simple - makes it easier when you involve other investors, lawyers, etc.

- Choice of entity - partnership vs. LLC vs. corporation (tax differences). Some make it harder to give stock options to employees, take on VC money, etc. C-corp is what most people do, etc. Important to stand the consequences 12 months down the line, and exit strategies.

- Importance of proper documentation - to identify who owns company, who owns IP, etc.

Recurring problems - IP - do you own it?

- Rights of former employers

- IP ownership rights

- NDAs

- Non-compete agreements - not enforceable in CA unless sale of business involved.

- Non-solicitation agreements - to stop you from going after customers

- IP ownership rights

- Basically, the contract that you signed with your current employer owns almost everything.

- Don't use your corporate e-mail, laptop, internet, etc. for your own IP.

- Rights of consultants in developed technology - need to have them sign the IP over to you.

- Rights of sponsors of non-commercial research, such as universities.

- Joint ownership isn't the solution - can lead to a lot of problems.

- Third party claims of infringement - proprietary code, open source. Buyers might be allergic to open source - using open source in the "wrong way" (i.e. GPL violation - proprietary code might have to be put out under open source license).

- Lack of adequate trade secret protection, absence of confidentiality agreement with employees, licensees, etc. Have to be consistent in protecting IP.

Founders Issues

- Who owns what? Get it in writing, so no mis-understandings down the line. While the company is worthless, important to get this stuff down.

- Who's on the board - succession and voting. Investors what board seats - don't want to see in-fighting about who is going to leave the board. Only 1 or 2 founders (at most) will stay on the board.

- Noncompetition agreements - among founders.

- breaking up is hard to do. Vesting - so if somebody leaves during vesting period, all of that stock can remain with the company.

- Transfer restrictions - right of refusal, drag-along, right of co-sale, IPO lock-up

- Internal Revenue Code Section 83(b) - IRS views vesting stock as taxable when it vests, not when it is granted - can get whacked since it starts low but value grows by vesting time.

- Loans usually a bad idea.

- Do it right, early, keep it simple - do it on paper.

Be Prepared

- Start organized, stay organized

- Do it right the first time with advisors who know what they're doing (lawyers, etc.)

- Someone in the company has to be compulsive about this!

- Give corporate legal records the same respect that you would the other things that you love (code, etc.).

So, Paul Graham's VC fund, Y Combinator, is throwing a one day event called Startup School over at Stanford today. A few weeks ago, I applied to attend, and luckily I was accepted. So, waking up far earlier than any mortal should be forced to (especially on a Saturday), I'm sitting in the Kresge auditorium over on the Stanford campus, ready to absorb the knowledge.

In leading up to today's event, I was reading a lot of pre-Startup School buzz -- it seems like most people are attending in order to network with other potential startup people. Looking for co-founders, selling business plans, looking for VC funding, etc. As for me, I'm not coming here with so many ambitions. I just want to know what the unknowns are - what are all of the things that I would even need to think about before starting a company?

So, I'll be taking notes (and trying to blog what I can) - hopefully this will be time well spent.

-Andy.